Price-to-Book P B Ratio: Meaning, Formula, and Example

Even if a company has a high book value per share, there’s no guarantee that it will be a successful investment. This is why it’s so important to do a lot of research before making any investment decisions. That said, looking deeper into book value will give you a better understanding of the company. In some cases, a company will use excess earnings to update equipment rather than pay out dividends or expand operations. In this case, the value of the assets should be reduced by the size of any secured loans tied to them. An investor looking to make a book value play has to be aware of any claims on the assets, especially if the company is a bankruptcy candidate.

Why Is the Price-to-Book (P/B) Ratio Important?

The stock market assigns a higher value to most companies because they have more earnings power than their assets. It indicates that investors believe the company has excellent future prospects for growth, expansion, and increased profits. They may also think the company’s value is higher than what the current book valuation calculation shows. Price-to-Book ratio or PB ratio is a common financial indicator for helping investors determine the company’s worth. Investors can use the PB ratio to evaluate if a stock is overpriced or undervalued to its book value.

How to calculate P/B ratio?

BVPS represents the accounting value of each share based on the company’s equity, while the market value per share is determined by the stock’s current trading price in the market. For instance, consider a company’s brand value, which is built through a series of marketing campaigns. U.S. generally accepted accounting principles (GAAP) require marketing costs to be expensed immediately, reducing the book value per share. However, if advertising efforts enhance the image of a company’s products, the company can charge premium prices and create brand value.

Market Value

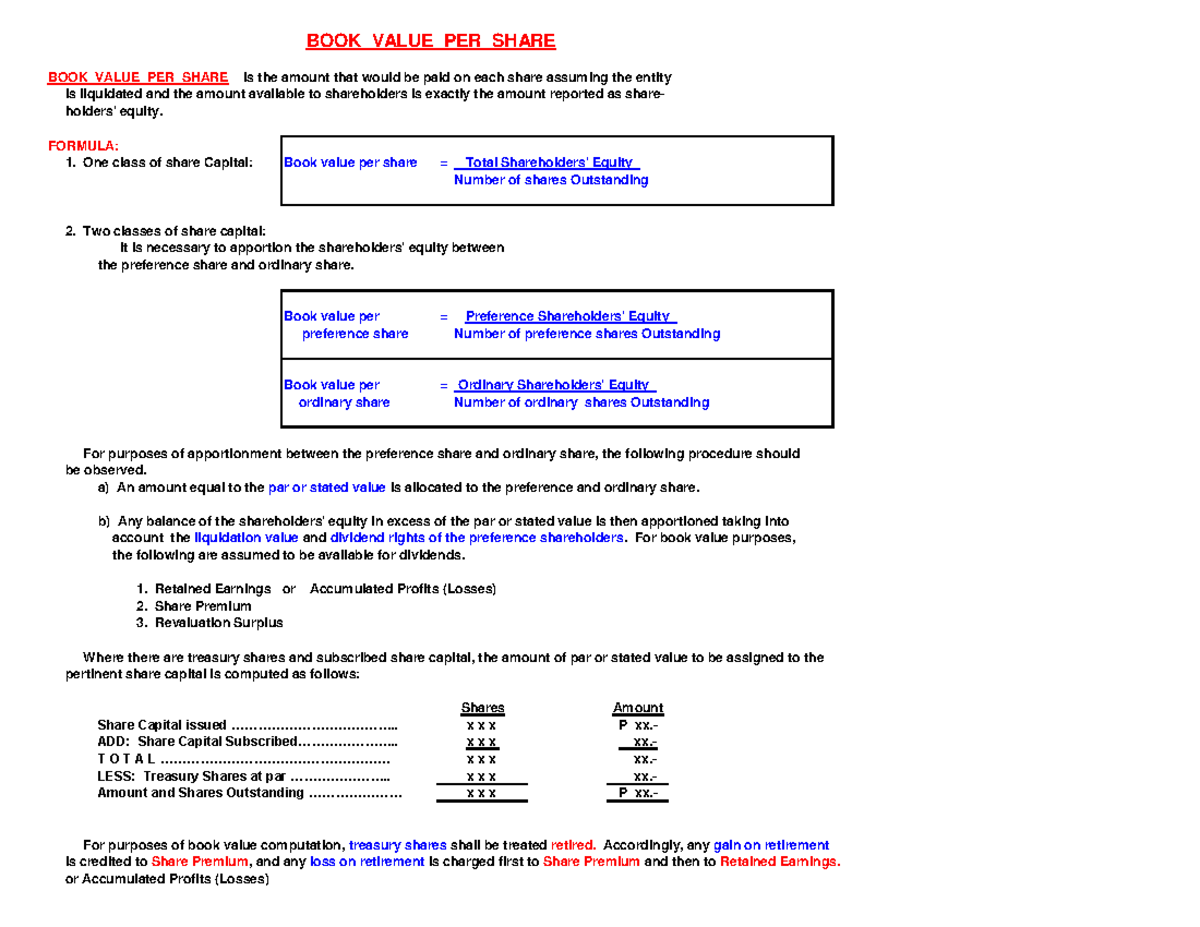

If, for example, the company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, common equity increases along with BVPS. On the other hand, if XYZ uses $300,000 of the earnings to reduce liabilities, common equity also increases. Book value per common share (or, simply book value per share – BVPS) is a method to calculate the per-share book value of a company based on common shareholders’ equity in the company. The book value of a company is the difference between that company’s total assets and total liabilities, and not its share price in the market.

P/B Ratio = Market Capitalisation / Book Value of Assets

Most publicly listed companies fulfill their capital needs through a combination of debt and equity. Companies get debt by taking loans from banks and other financial institutions or by floating interest-paying corporate bonds. They typically raise equity capital by listing the shares on the stock exchange through an initial public offering (IPO). Sometimes, companies get equity capital through other measures, such as follow-on issues, rights issues, and additional share sales.

Minority interest is the ownership of less than 50 percent of a subsidiary’s equity by an investor or a company other than the parent company. Investors can find a company’s financial information in quarterly and annual reports on its investor relations page. However, it is often easier to get the information by going to a ticker, such as AAPL, and scrolling down to the fundamental data section.

- Sandra’s areas of focus include advising real estate agents, brokers, and investors.

- Additionally, depreciation-linked rules and accounting practices can create other issues.

- SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here).

- Equity investors aim for dividend income or capital gains driven by increases in stock prices.

This differs from the book value for investors because it is only used internally for managerial accounting purposes. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

The book value of a company is equal to its total assets minus its total liabilities. The total assets and total liabilities are on the company’s balance sheet in annual and quarterly reports. Profitable companies typically have market values greater than book values. Most of the companies in cloud accounting case studies the top indexes meet this standard, as seen from the examples of Microsoft and Walmart mentioned above. However, it may also indicate overvalued or overbought stocks trading at high prices. As the market price of shares changes throughout the day, the market cap of a company does so as well.

If the company’s BVPS increases, investors may consider the stock more valuable, and the stock’s price may increase. On the other hand, a declining book value per share could indicate that the stock’s price may decline, and some investors might consider that a signal to sell the stock. The figure of 1.25 indicates that the market has priced shares at a premium to the book value of a share. There is a difference between outstanding and issued shares, but some companies might refer to outstanding common shares as issued shares in their reports.

Market demand may increase the stock price, which results in a large divergence between the market and book values per share. Investors can calculate it easily if they have the balance sheet of a company of interest. Investors can compare BVPS to a stock’s market price to get an idea of whether that stock is overvalued or undervalued.

Annual additions to accumulated depreciation are intended to reflect an asset’s loss of value over time. But these are formulaic accounting entries — such that an asset’s book value doesn’t necessarily align with its market value. That’s important to keep in mind when analyzing a company’s book value because it is partially defined by asset-carrying values. Book value is an accounting term, a metric investors use in fundamental analysis.

Yorum gönder